All Categories

Featured

Table of Contents

Which one you select depends on your requirements and whether or not the insurance company will certainly authorize it. Plans can additionally last until specified ages, which most of the times are 65. Due to the countless terms it supplies, level life insurance coverage gives prospective policyholders with versatile alternatives. However past this surface-level info, having a higher understanding of what these strategies entail will certainly help ensure you buy a policy that satisfies your demands.

Be conscious that the term you choose will certainly affect the premiums you spend for the policy. A 10-year level term life insurance policy policy will certainly set you back less than a 30-year plan due to the fact that there's less possibility of an occurrence while the plan is active. Lower threat for the insurance company equates to decrease premiums for the insurance policy holder.

Your family members's age ought to additionally affect your policy term option. If you have kids, a longer term makes sense because it secures them for a longer time. If your kids are near the adult years and will certainly be economically independent in the close to future, a much shorter term could be a better fit for you than an extensive one.

When comparing whole life insurance vs. term life insurance coverage, it's worth noting that the last generally sets you back less than the previous. The result is more insurance coverage with reduced costs, offering the ideal of both globes if you need a considerable quantity of coverage yet can't manage a much more pricey policy.

The Meaning of Term Life Insurance For Seniors

A level survivor benefit for a term policy generally pays out as a round figure. When that takes place, your beneficiaries will obtain the entire quantity in a solitary settlement, which amount is ruled out income by the IRS. Those life insurance coverage profits aren't taxed. Nevertheless, some level term life insurance policy companies allow fixed-period payments.

Interest settlements received from life insurance plans are thought about earnings and are subject to tax. When your degree term life policy expires, a few various points can occur.

The downside is that your renewable level term life insurance policy will certainly include higher costs after its first expiration. Advertisements by Money. We may be compensated if you click this ad. Advertisement For beginners, life insurance can be complicated and you'll have concerns you want responded to prior to committing to any plan.

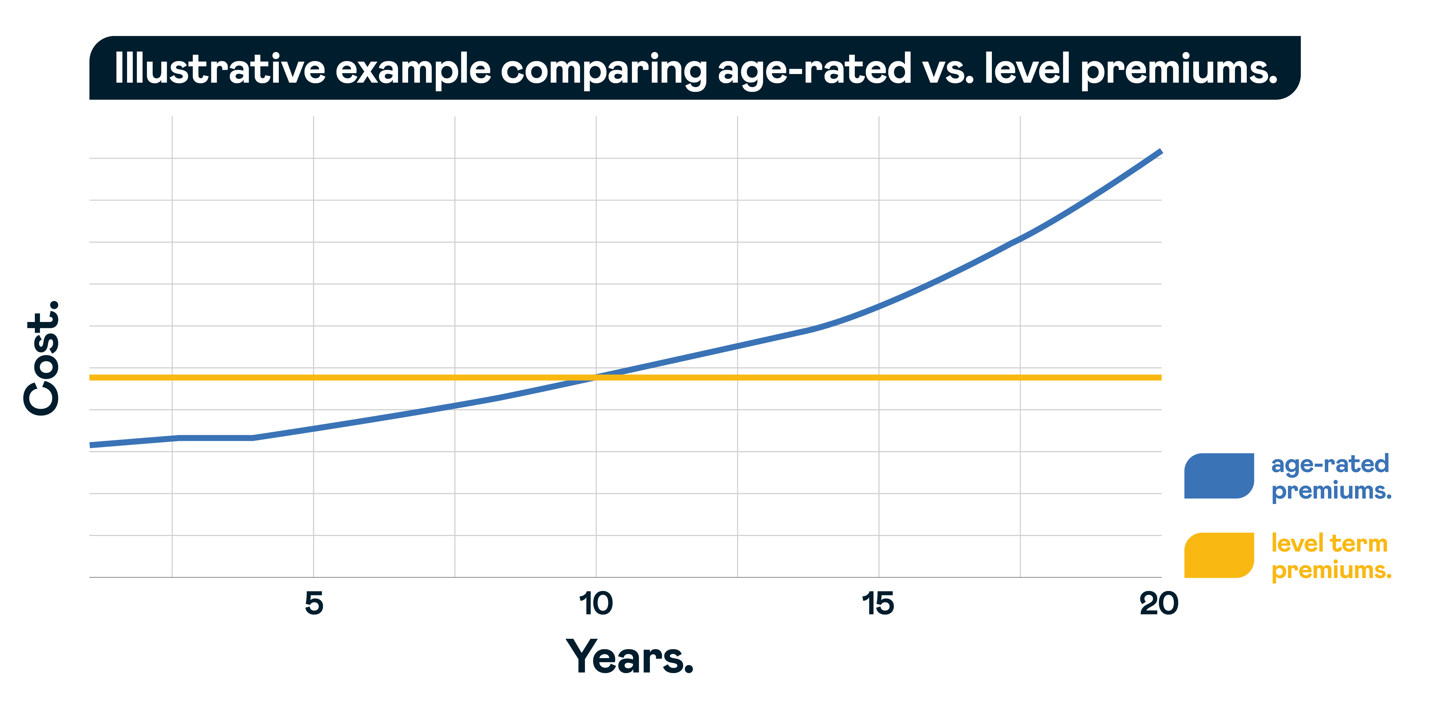

Life insurance business have a formula for computing risk making use of death and rate of interest (Term life insurance with level premiums). Insurance providers have thousands of clients obtaining term life policies at the same time and utilize the premiums from its active plans to pay surviving beneficiaries of various other plans. These companies utilize mortality to approximate the amount of individuals within a specific team will certainly submit fatality insurance claims each year, which details is made use of to figure out ordinary life span for possible insurance policy holders

Furthermore, insurance companies can spend the cash they obtain from premiums and enhance their earnings. Given that a degree term plan doesn't have money worth, as an insurance policy holder, you can't invest these funds and they do not supply retired life income for you as they can with entire life insurance policy plans. The insurance policy company can spend the cash and make returns.

The list below area information the advantages and disadvantages of level term life insurance policy. Predictable costs and life insurance coverage Streamlined policy structure Prospective for conversion to irreversible life insurance Restricted insurance coverage duration No money value buildup Life insurance policy premiums can increase after the term You'll find clear benefits when contrasting level term life insurance policy to various other insurance policy types.

What is Level Term Life Insurance? Your Essential Questions Answered?

From the minute you take out a plan, your costs will never ever alter, helping you intend monetarily. Your coverage will not vary either, making these plans efficient for estate preparation.

If you go this course, your costs will certainly boost but it's constantly good to have some adaptability if you wish to maintain an active life insurance policy policy. Sustainable degree term life insurance policy is one more alternative worth thinking about. These policies permit you to keep your current plan after expiration, offering flexibility in the future.

How Does What Does Level Term Life Insurance Mean Work for Families?

Unlike a whole life insurance plan, level term insurance coverage doesn't last forever. You'll select a protection term with the most effective degree term life insurance prices, yet you'll no more have insurance coverage once the strategy ends. This downside can leave you rushing to locate a brand-new life insurance policy plan in your later years, or paying a costs to expand your current one.

Many entire, universal and variable life insurance policy plans have a money worth element. With among those policies, the insurance firm deposits a section of your month-to-month premium payments into a money worth account. This account makes rate of interest or is invested, helping it expand and provide a more substantial payout for your recipients.

With a degree term life insurance plan, this is not the case as there is no money value part. As a result, your plan will not expand, and your survivor benefit will certainly never increase, therefore restricting the payment your recipients will certainly get. If you desire a plan that gives a survivor benefit and develops money worth, check into whole, universal or variable strategies.

The 2nd your plan runs out, you'll no longer have life insurance policy coverage. Degree term and reducing life insurance coverage offer comparable plans, with the major difference being the death benefit.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - life insurance with tax benefits through brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

It's a kind of cover you have for a particular quantity of time, recognized as term life insurance policy. If you were to pass away while you're covered for (the term), your loved ones receive a fixed payout agreed when you secure the plan. You simply choose the term and the cover quantity which you could base, for example, on the price of elevating kids till they leave home and you can utilize the payment in the direction of: Helping to repay your home loan, debts, bank card or finances Helping to spend for your funeral expenses Assisting to pay university fees or wedding expenses for your youngsters Helping to pay living costs, replacing your earnings.

What is Level Term Life Insurance Policy Coverage Like?

The plan has no money value so if your settlements quit, so does your cover. The payment remains the same throughout the term. As an example, if you take out a degree term life insurance policy plan you can: Select a repaired quantity of 250,000 over a 25-year term. If during this time around you die, the payment of 250,000 will certainly be made.

Table of Contents

Latest Posts

Iselect Funeral Insurance

What's The Best Funeral Plan

Assurant Burial Insurance

More

Latest Posts

Iselect Funeral Insurance

What's The Best Funeral Plan

Assurant Burial Insurance