All Categories

Featured

Table of Contents

If George is detected with a terminal illness throughout the first policy term, he most likely will not be eligible to renew the plan when it expires. Some plans offer guaranteed re-insurability (without proof of insurability), but such features come at a higher cost. There are numerous kinds of term life insurance.

Typically, most business use terms ranging from 10 to 30 years, although a couple of deal 35- and 40-year terms. Level-premium insurance coverage has a set month-to-month repayment for the life of the policy. The majority of term life insurance coverage has a degree costs, and it's the type we have actually been referring to in the majority of this post.

Term life insurance policy is appealing to youngsters with children. Parents can acquire considerable protection for an inexpensive, and if the insured passes away while the policy holds, the family members can count on the survivor benefit to replace lost revenue. These policies are also appropriate for individuals with growing family members.

What is Level Term Vs Decreasing Term Life Insurance? An Overview for New Buyers?

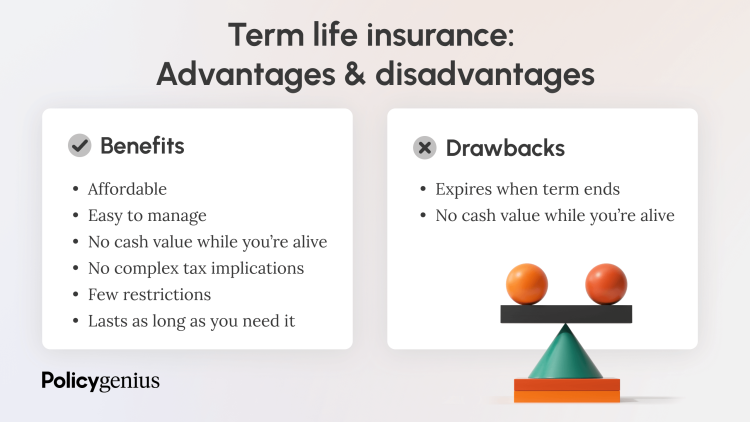

The ideal selection for you will certainly rely on your needs. Here are some points to consider. Term life plans are ideal for individuals that want significant protection at an inexpensive. Individuals that own entire life insurance policy pay a lot more in premiums for less protection but have the safety of understanding they are shielded permanently.

The conversion rider should enable you to transform to any long-term plan the insurer provides without limitations. The primary features of the rider are keeping the original wellness ranking of the term plan upon conversion (also if you later on have wellness concerns or end up being uninsurable) and making a decision when and just how much of the protection to transform.

Of course, total costs will increase significantly considering that entire life insurance is extra pricey than term life insurance policy. Clinical problems that establish during the term life period can not trigger premiums to be increased.

The Ultimate Guide: What is 30-year Level Term Life Insurance?

Term life insurance policy is a relatively cost-effective way to give a swelling amount to your dependents if something happens to you. It can be an excellent alternative if you are young and healthy and support a family members. Whole life insurance policy includes significantly greater regular monthly premiums. It is suggested to give protection for as lengthy as you live.

Insurance policy firms established an optimum age restriction for term life insurance policies. The costs also climbs with age, so an individual matured 60 or 70 will pay substantially more than somebody years more youthful.

Term life is rather similar to cars and truck insurance. It's statistically unlikely that you'll require it, and the premiums are money down the tubes if you don't. If the worst happens, your family will get the advantages.

Why You Should Consider Level Premium Term Life Insurance Policies

For the many component, there are 2 sorts of life insurance coverage plans - either term or irreversible strategies or some mix of both. Life insurers use numerous forms of term strategies and standard life plans in addition to "rate of interest delicate" items which have come to be extra prevalent given that the 1980's.

Term insurance policy provides defense for a specified time period. This duration could be as short as one year or give coverage for a specific variety of years such as 5, 10, 20 years or to a defined age such as 80 or in many cases up to the oldest age in the life insurance policy mortality.

How Do You Define Short Term Life Insurance?

Currently term insurance policy rates are really competitive and among the least expensive traditionally experienced. It should be kept in mind that it is a commonly held belief that term insurance is the least expensive pure life insurance policy coverage readily available. One requires to examine the plan terms meticulously to choose which term life choices are appropriate to meet your particular conditions.

With each new term the premium is enhanced. The right to renew the policy without evidence of insurability is a vital advantage to you. Or else, the danger you take is that your health and wellness might weaken and you might be incapable to acquire a policy at the very same rates or even at all, leaving you and your recipients without coverage.

The length of the conversion duration will vary depending on the type of term plan acquired. The costs price you pay on conversion is usually based on your "existing acquired age", which is your age on the conversion day.

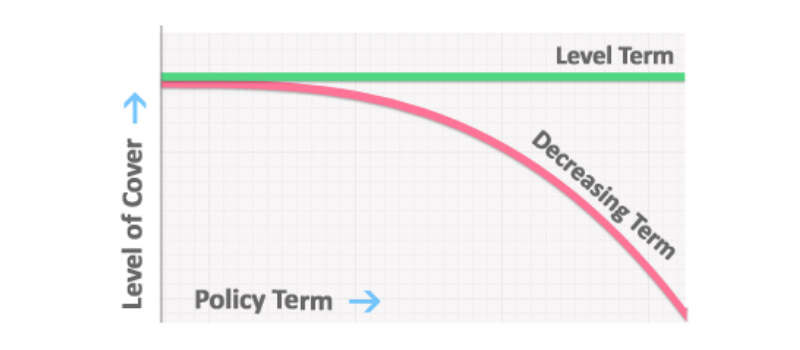

Under a level term policy the face amount of the policy remains the same for the whole period. Often such policies are sold as mortgage defense with the quantity of insurance policy decreasing as the balance of the home loan decreases.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. whole life insurance brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

Commonly, insurance providers have actually not deserved to transform premiums after the policy is marketed. Because such plans may continue for years, insurance companies have to use conservative death, passion and expense rate estimates in the costs estimation. Flexible costs insurance, however, enables insurers to supply insurance at lower "existing" premiums based upon much less conventional presumptions with the right to transform these premiums in the future.

What Is What Does Level Term Life Insurance Mean? The Complete Overview?

While term insurance coverage is created to supply defense for a defined time period, irreversible insurance is made to supply insurance coverage for your whole lifetime. To keep the premium price degree, the costs at the more youthful ages surpasses the real price of defense. This additional costs develops a get (cash worth) which assists pay for the plan in later years as the cost of defense rises over the premium.

Under some policies, costs are needed to be paid for an established variety of years (Increasing term life insurance). Under various other plans, costs are paid throughout the insurance holder's lifetime. The insurance provider invests the excess premium dollars This type of policy, which is often called cash value life insurance policy, generates a financial savings aspect. Cash money values are crucial to an irreversible life insurance coverage policy.

Sometimes, there is no connection in between the size of the money worth and the costs paid. It is the cash worth of the plan that can be accessed while the policyholder is alive. The Commissioners 1980 Requirement Ordinary Mortality (CSO) is the current table made use of in determining minimal nonforfeiture values and policy reserves for normal life insurance policy plans.

Why Term Life Insurance For Seniors Matters

Many permanent plans will contain stipulations, which define these tax needs. Conventional whole life policies are based upon lasting price quotes of cost, passion and death.

Table of Contents

Latest Posts

Iselect Funeral Insurance

What's The Best Funeral Plan

Assurant Burial Insurance

More

Latest Posts

Iselect Funeral Insurance

What's The Best Funeral Plan

Assurant Burial Insurance