All Categories

Featured

Table of Contents

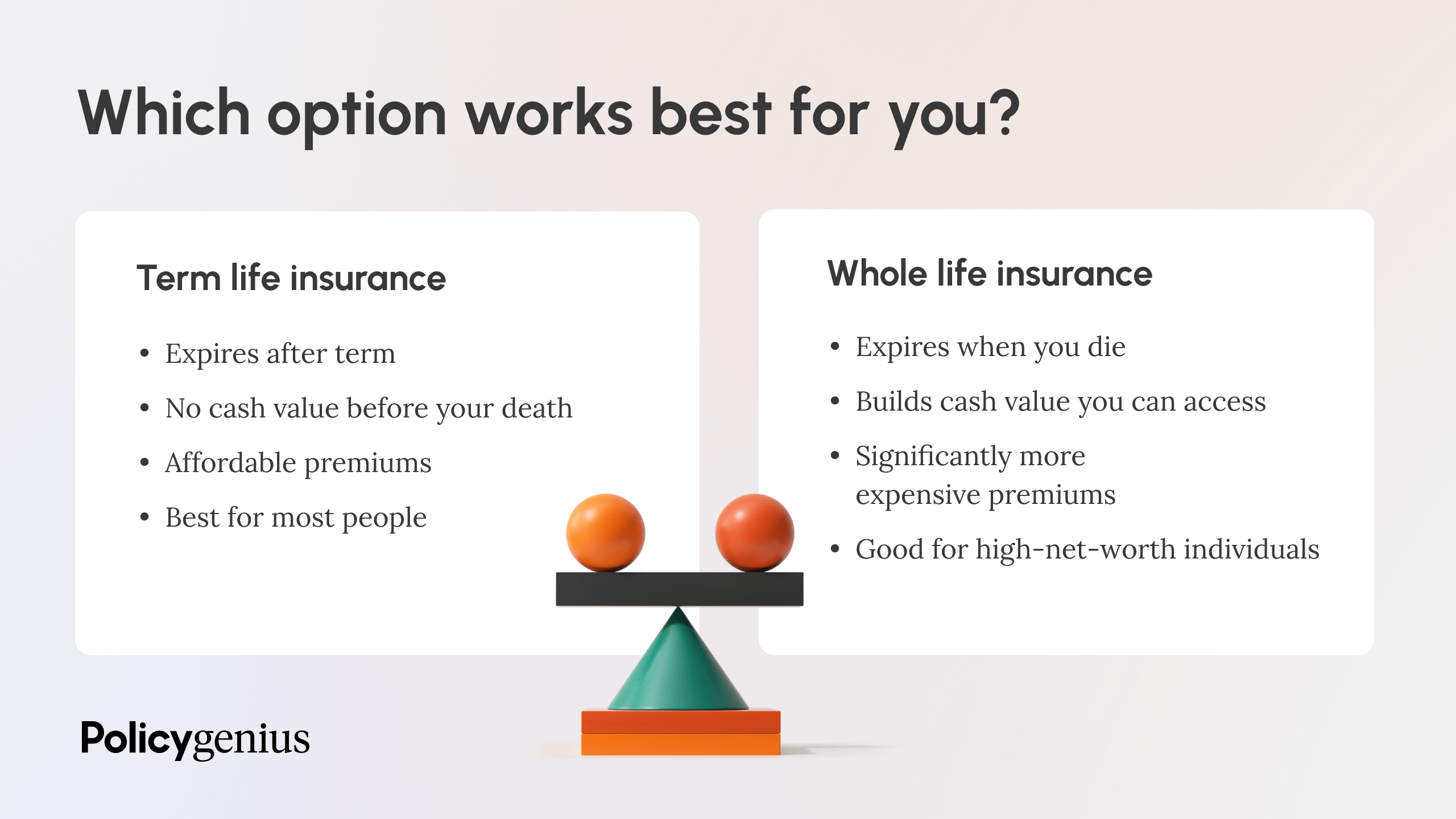

Interest in solitary premium life insurance policy is largely due to the tax-deferred treatment of the build-up of its money worths. Tax obligations will be incurred on the gain, nevertheless, when you give up the policy.

The advantage is that improvements in rate of interest will be reflected faster in interest delicate insurance than in traditional; the disadvantage, obviously, is that lowers in rate of interest will likewise be felt more swiftly in rate of interest delicate entire life. There are 4 standard passion sensitive whole life policies: The universal life policy is really more than passion delicate as it is designed to mirror the insurance firm's current mortality and expense as well as rate of interest incomes instead of historical rates.

What is What Is Direct Term Life Insurance? Find Out Here

The firm debts your premiums to the cash money worth account. Regularly the company deducts from the cash money worth account its costs and the cost of insurance protection, typically referred to as the death deduction fee. The equilibrium of the cash value account collects at the passion attributed. The company ensures a minimal rates of interest and a maximum death fee. Level premium term life insurance.

These assurances are normally really conventional. Current presumptions are important to rate of interest sensitive products such as Universal Life. When rates of interest are high, benefit forecasts (such as cash money worth) are also high - Level premium term life insurance. When rates of interest are low, these estimates are not as eye-catching. Universal life is also the most adaptable of all the numerous kinds of plans.

The policy normally gives you a choice to pick a couple of kinds of survivor benefit - Level term life insurance. Under one alternative your beneficiaries received just the face amount of the policy, under the other they receive both the face amount and the cash money value account. If you want the maximum amount of survivor benefit currently, the 2nd option needs to be picked

What Does What Does Level Term Life Insurance Mean Mean for You?

It is vital that these presumptions be practical since if they are not, you may need to pay more to maintain the plan from lowering or lapsing. On the various other hand, if your experience is much better then the presumptions, than you might be able in the future to skip a premium, to pay much less, or to have the plan paid up at an early day.

On the various other hand, if you pay more, and your assumptions are sensible, it is possible to pay up the policy at a very early day. If you surrender an universal life policy you may obtain less than the money worth account as a result of surrender fees which can be of 2 types.

A back-end type policy would certainly be more suitable if you mean to maintain insurance coverage, and the fee lowers with each year you proceed the policy. Keep in mind that the interest price and cost and death costs payables at first are not assured for the life of the policy. This kind of plan offers you maximum adaptability, you will need to proactively take care of the plan to maintain sufficient financing, especially since the insurance policy company can boost death and cost fees.

You may be asked to make extra costs payments where insurance coverage might end due to the fact that the rate of interest went down. Your starting rate of interest is taken care of only for a year or sometimes three to 5 years. The ensured price attended to in the policy is much reduced (e.g., 4%). One more feature that is sometimes emphasized is the "no cost" finance.

You have to obtain a certification of insurance policy defining the stipulations of the group plan and any kind of insurance cost. Normally the optimum amount of protection is $220,000 for a mortgage and $55,000 for all other financial debts. Credit rating life insurance policy need not be bought from the company providing the loan.

If life insurance coverage is called for by a creditor as a condition for making a funding, you may be able to designate an existing life insurance policy plan, if you have one. You may want to buy group credit history life insurance coverage in spite of its higher price due to the fact that of its benefit and its availability, typically without detailed evidence of insurability.

What is What Does Level Term Life Insurance Mean? How It Works and Why It Matters?

Nonetheless, home collections are not made and costs are mailed by you to the representative or to the company. There are particular elements that tend to increase the costs of debit insurance coverage greater than normal life insurance policy plans: Specific expenses are the exact same no issue what the dimension of the policy, to ensure that smaller policies issued as debit insurance will certainly have greater premiums per $1,000 of insurance than larger size routine insurance plan.

Since early lapses are expensive to a firm, the prices have to be passed on to all debit policyholders (term life insurance for seniors). Considering that debit insurance is designed to consist of home collections, higher payments and costs are paid on debit insurance than on routine insurance policy. Oftentimes these greater expenses are passed on to the insurance holder

Where a company has different costs for debit and normal insurance policy it may be feasible for you to purchase a larger amount of regular insurance than debit at no extra cost. For that reason, if you are thinking about debit insurance policy, you should absolutely explore normal life insurance as a cost-saving alternative.

This plan is developed for those that can not initially manage the routine whole life costs yet that want the higher costs protection and feel they will become able to pay the higher premium. The family members plan is a combination strategy that supplies insurance coverage defense under one agreement to all members of your prompt family hubby, other half and children.

Joint Life and Survivor Insurance policy gives insurance coverage for 2 or even more individuals with the survivor benefit payable at the death of the last of the insureds. Costs are substantially reduced under joint life and survivor insurance policy than for policies that guarantee only one individual, considering that the likelihood of having to pay a death case is lower.

What is Term Life Insurance For Seniors Coverage?

Premiums are substantially greater than for policies that guarantee someone, considering that the probability of having to pay a death claim is greater. Endowment insurance policy attends to the repayment of the face amount to your recipient if fatality happens within a particular duration of time such as twenty years, or, if at the end of the certain duration you are still to life, for the repayment of the face quantity to you.

Juvenile insurance coverage supplies a minimum of defense and could supply protection, which might not be available at a later date. Amounts provided under such protection are typically limited based upon the age of the child. The existing limitations for minors under the age of 14.5 would be the greater of $50,000 or 50% of the quantity of life insurance policy in pressure upon the life of the applicant.

Juvenile insurance policy may be sold with a payor benefit rider, which offers for waiving future costs on the child's plan in the occasion of the death of the individual who pays the premium. Senior life insurance, occasionally referred to as graded fatality benefit strategies, offers eligible older applicants with very little whole life protection without a medical checkup.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. life insurance with living benefits brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

Latest Posts

Iselect Funeral Insurance

What's The Best Funeral Plan

Assurant Burial Insurance